2023 ✦ Product Design

Traditional ESG/SRI investing has become increasingly popular but it has some shortcomings. ESG portfolios are often too general and may not reflect a user's unique values. There is a lack of products that can accurately and at scale capture a user's views and values. Many traditional RIA's have high investment minimums and require a deep assessment of a user's goals before they can create a personalized portfolio (Ethic, Vanguard, Fidelity).

Delphia was uniquely equipped to offer custom direct index portfolios with low investment minimums. Delphia had access to technology that was capable of accurately extracting the ideologies of users through frequent surveying. There was an opportunity to combine these tools to create a portfolio that would accurately reflected users’ views of the world and could scale for a mass audience.

Insight from continuous discovery

Through the practice of continuous discovery at Delphia, we learned that our customers wanted greater customizability of their investment portfolios.

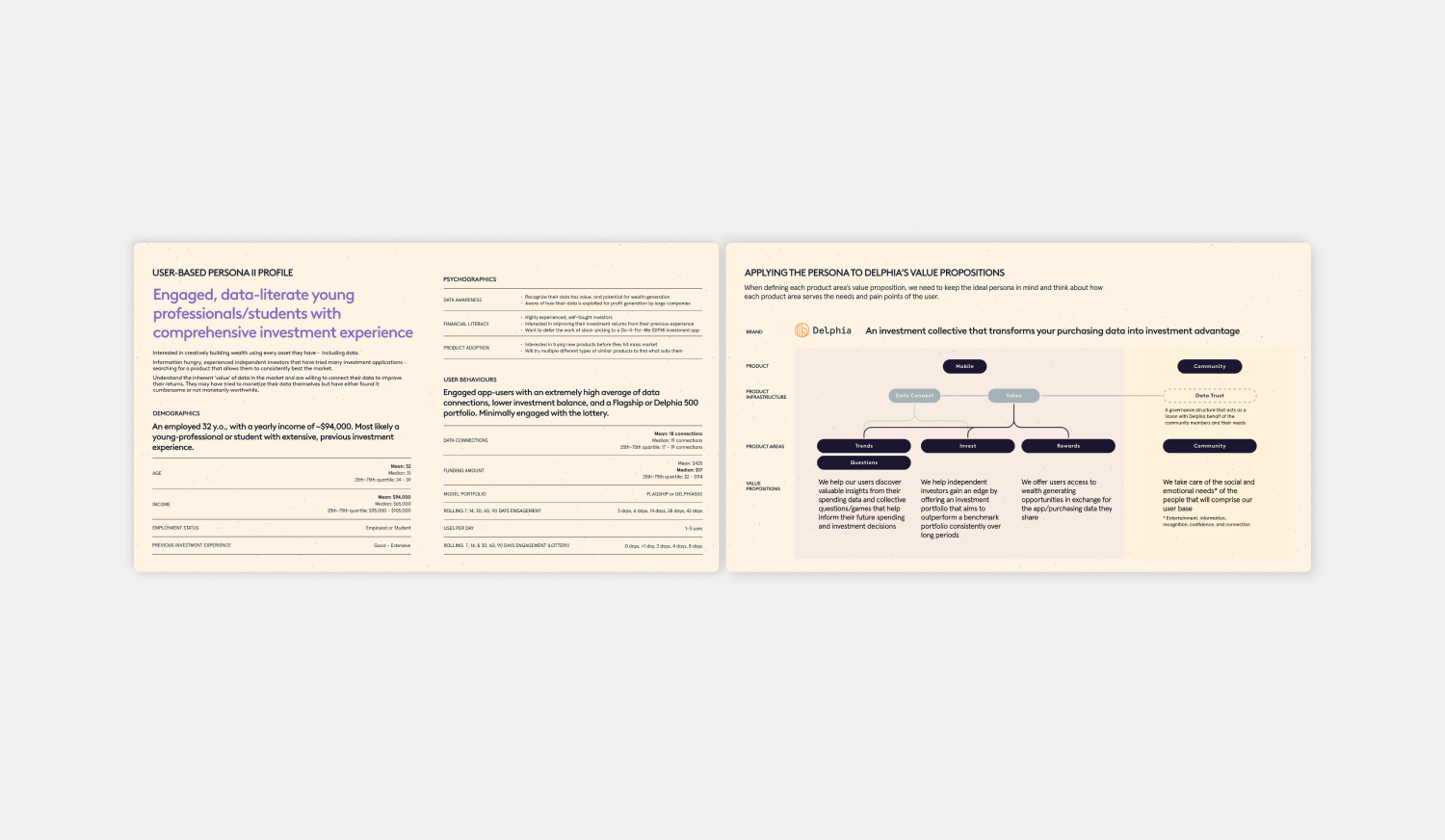

The Investment Engine team had a vision to acquire more user data about the values of our users and to provide them a personalized portfolio that aligned to their values. Delphia’s goal was to have a richer data profile for the user and to create a persona — of who Delphia’s user was and what they valued.

Product Design Lead

Client: Delphia

Project Type: Product Design

Role: Senior Product Designer, Design Lead

Duration: 6 weeks

Testing our initial assumptions

As part of our discovery work, we wanted to understand:

- How our users utilized the current Delphia investment product.

- What our users understood about values-based investing and what motivates them to invest.

- If customized portfolios were something our users really cared about, something they wanted, and what the current gaps or barriers existed in their past experience.

Our research process

I interviewed current users and non-users of Delphia and ran concept testing to inform MVP design direction.

- 8 moderated interviews

- 3 Delphia users

- 5 non-Delphia users

- Previous Continuous Discovery transcript analysis

- Competitive analysis

The current user experience of Delphia's direct index portfolios

- Delphia offers users the ability to choose between 4 different, pre-determined portfolios based on risk level

- Users are unable to adjust the allocation or holdings of their portfolio

- Users are unable to view the performance of sectors or securities in their portfolio

- Users are unable to exclude securities from their portfolio or add specific securities to their portfolio

- Delphia’s current offering of pre-set, direct index investment portfolios hinders the ability to provide a personalized and customizable portfolio.

What customizability do users want?

- Users were interested in the exact asset allocation of their portfolio and would navigate between multiple apps to understand what stocks their portfolio was invested in.

- Users were interested in the performance of different assets within their portfolio and the impact these assets had on their overall return.

- When users are assessing a portfolio, their primary concern is absolute returns and forecasted performance.

- Customizing asset allocation while maintaining performance was more appealing than investing in a broad ESG portfolio.

- Users wanted a portfolio that performed well but also reflected their values.

Offering personalized portfolios

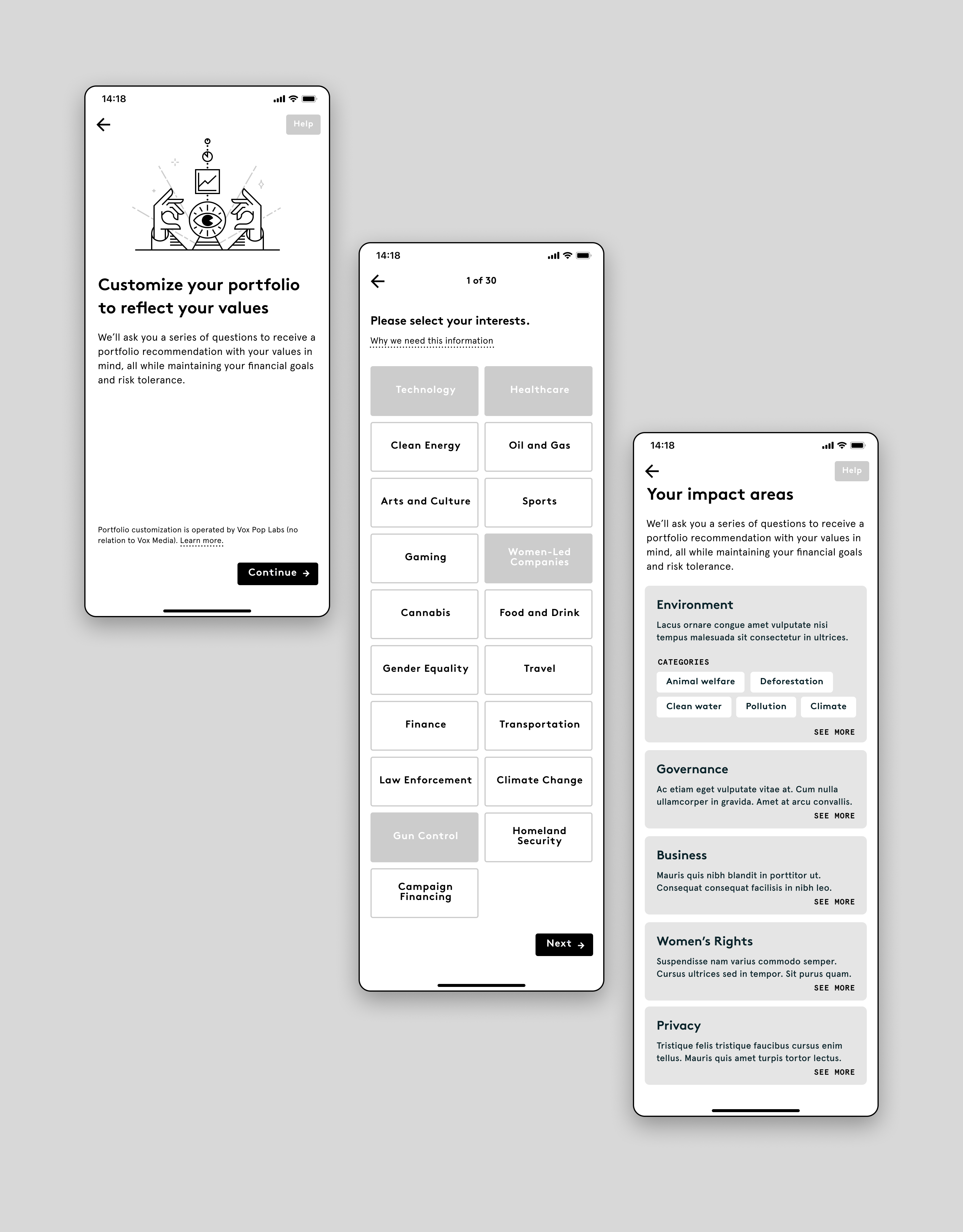

Wire-framing the personalization experience

To present a user with a portfolio that reflects their values, you would need to introduce a questionnaire during the onboarding experience that gets at the user's values, interests, preferences, and more. This new onboarding experience builds upon the traditional risk assessment and allows users to identify what sectors, political issues, and values they care about.

The answers provided during the personalization questionnaire determine key areas of impact, which categorize the portfolio holdings. Based on their risk level, users would receive a tailored portfolio that includes recommended securities within each of these categories.

Portfolio selection

After completing the personalization questionnaire, users receive recommendations for stocks and holdings categorized by their top Areas of Impact.

- The user's questionnaire determines the areas of impact present in their portfolio, as well as the corresponding percentage allocations.

- Users have the ability to adjust their risk level, which in turn modifies the percentage allocations for each area of impact and subsequent stock recommendation.

- Users can view historical performance of their recommended portfolio.

- Users can choose to edit their areas of impact or add the portfolio to their investment account.

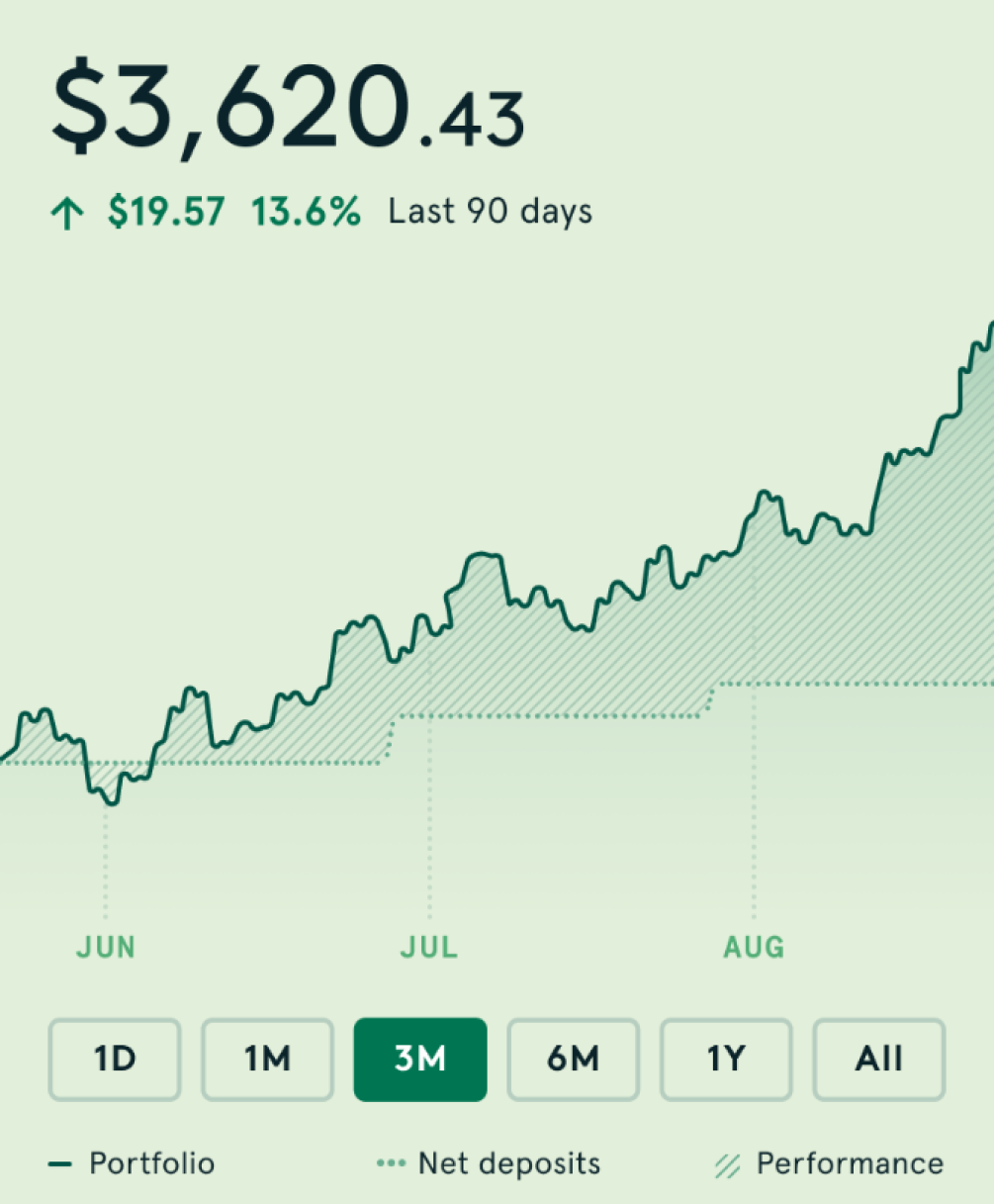

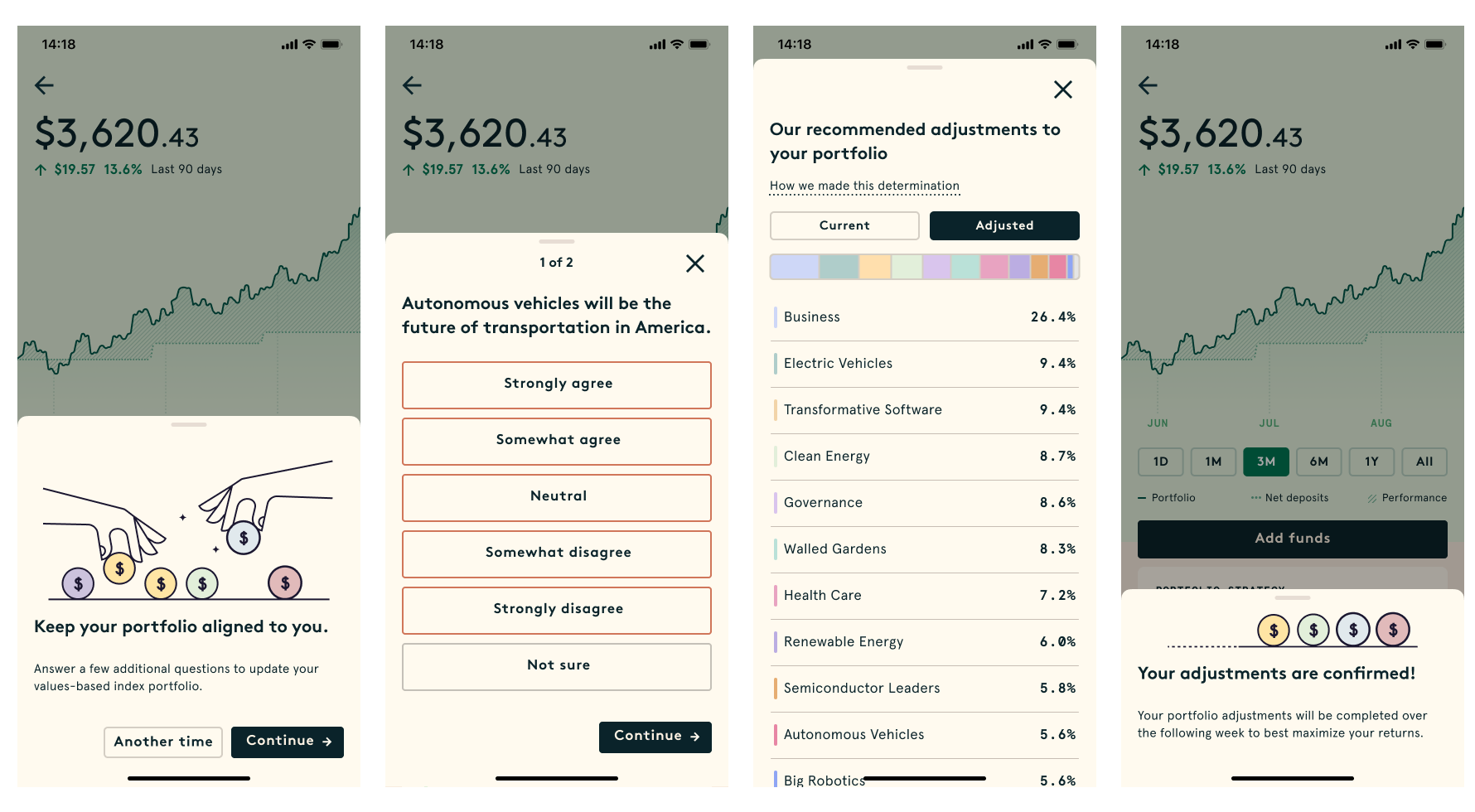

Assessing performance + impact

The updated Investment screen provides a comprehensive user experience for viewing portfolio allocations, performance, investments, trade activity, and related news. This represents an improvement over the previous UX.

- Users can view their portfolio's total value and performance in relation to their net deposits.

- The investment screen focuses on a user's areas of impact and the positions included in their portfolio.

- Users have greater customizability in their investment portfolio.

- Allow users to view news and updates about specific stocks within the app. This will enable them to learn more about the companies they are invested in without having to leave the app to find that information elsewhere.

Offering continued personalization

To provide a personalized portfolio that remains up to date with a user's values and interests, I designed a continuous surveying feature that allowsDelphia to frequently update the user's data profile and adjust their portfolio with any changes.

Users answer a series of questions, similar to the personalization questionnaire, to either fill gaps in previously undetermined information or update their existing information. With this data, Delphia can have a richer data profile of its users and achieve greater data under management, thus improving its proprietary stock-trading algorithm.

my work

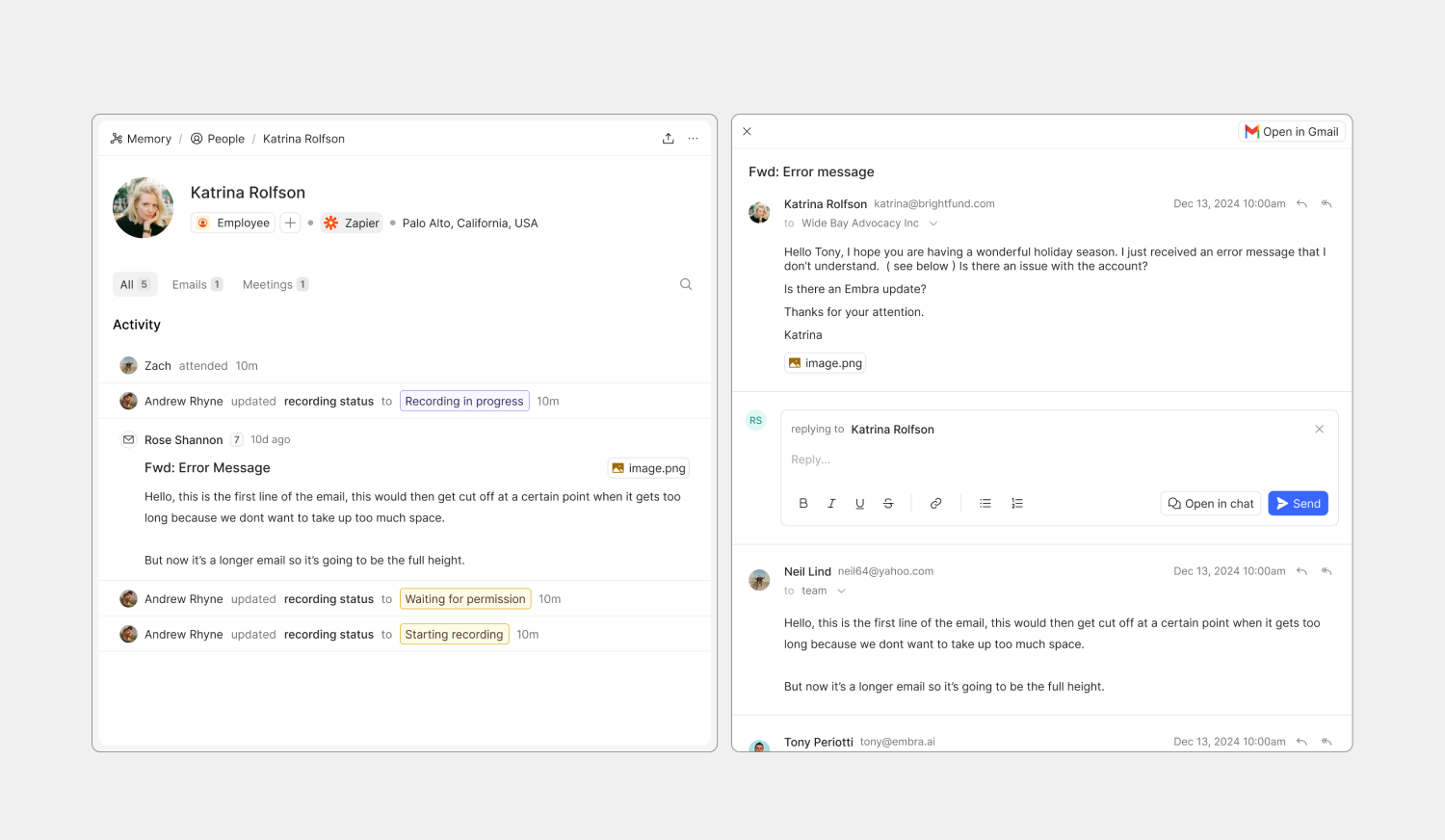

Ingesting Email into EmbraProject type

Building Embra's MemoryProject type

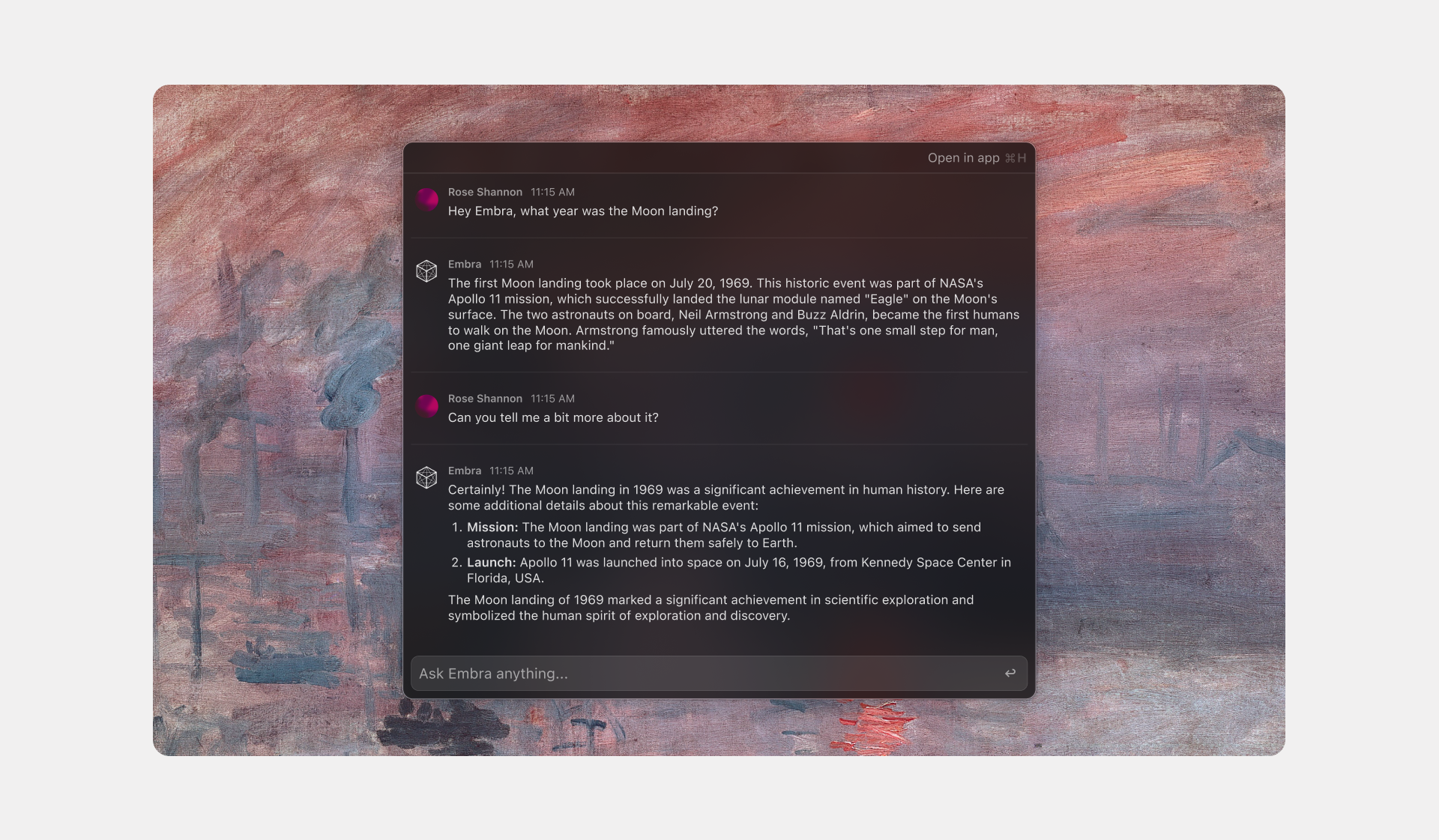

OS OverlayProject type

Meta DTC StoreService Design

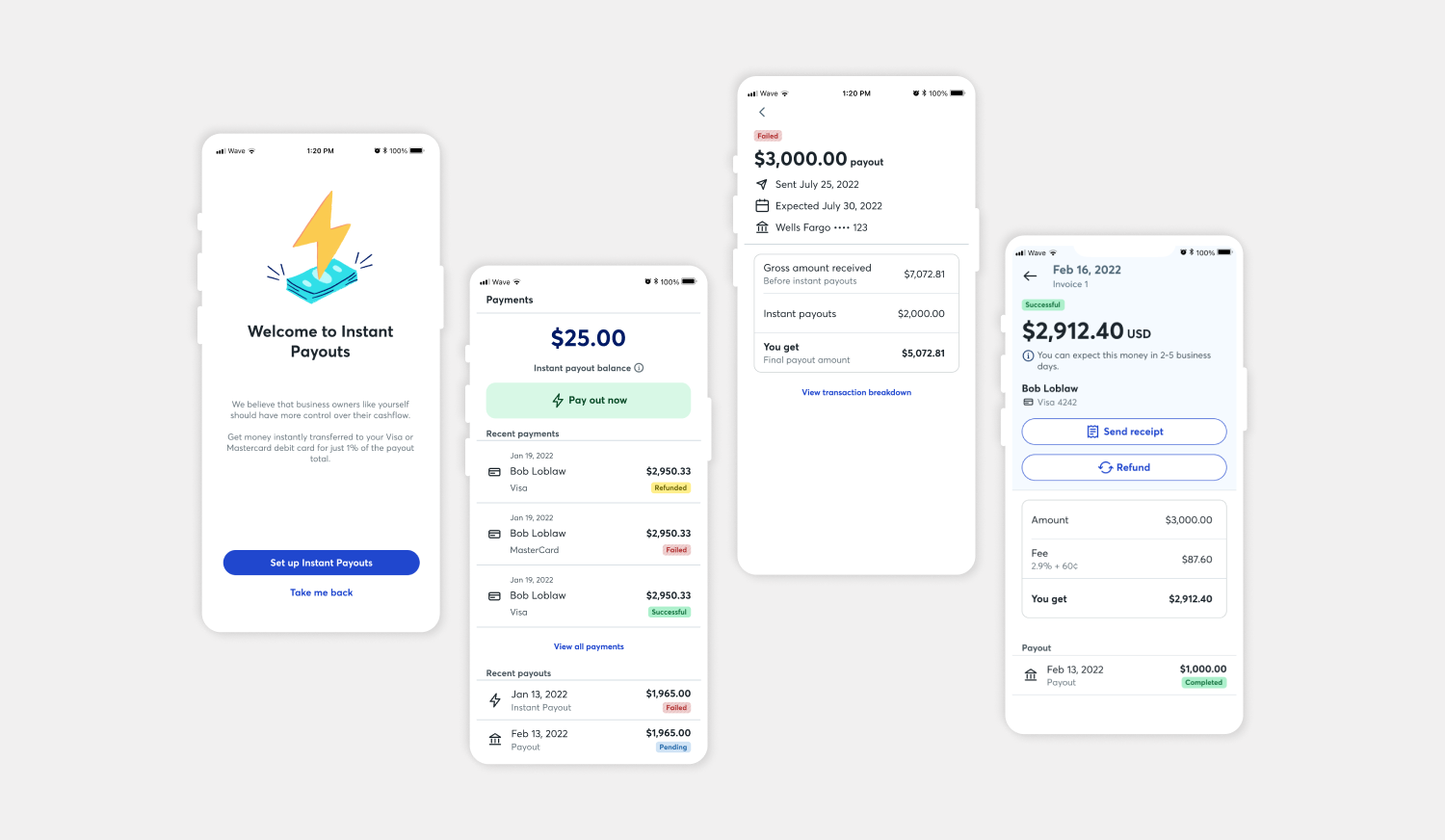

Wave PaymentsProduct Design

Persona DefinitionProject type